Why WeWork 🏤 Global went bankrupt but WeWork India 🇮🇳 is growing and profitable 💸?

👋🏽 Thanks for diving deeper into another article from Suraj’s Newsletter.

I invest my time along with a full-time job to help you get a nuanced and insightful story about an Indian and Global startup or business each week which is full of learnings to make you a better thinker and leader. I’d love it if you subscribe to the newsletter which will motivate me to continue writing for you all. I promise no spam.

We all have heard of WeWork, most of us define it as a fancy co-working space and I’m sure no one hates them. (Thanks to their swanky offices and pantries full of snacks ☕) We all have read about their problems like eccentric CEO, Softbank throwing billions of 💲💲 without any accountability, expensive office leases, overpaid non-core business acquisitions (Meetup, Wavegarden, etc.), and finally their news of bankruptcy this month! But did you know 🤷🏽♂️ that WeWork India 🇮🇳 business is profitable and growing !!

In CY2022, (CY: Calendar Year) WeWork (Listed company on NewYork stock exchange) reported a revenue of $3.24Bn up from $2.57Bn in CY2021 which is a 26% growth but made a loss of $1.5Bn. At the same time in CY2022 WeWork India reported a revenue of $160Mn up from $92Mn in CY2021 which is a 70% growth and made an operating profit of $22Mn.

In CY2023 Q2 (Apr-Jun) WeWork global reported a revenue of $849Mn with a growth of <1% from last quarter but for the same period WeWork India 🇮🇳 reported a revenue of $50Mn with a growth of 25% from last quarter and again WeWork global lost money and WeWork India registered profit! So what is working for WeWork India that's making it grow and generate profit against WeWork global?

Let’s Decode!

0/How and when was WeWork Born? 🐣

Adam Neumann and Miguel Mckelvey worked in the same office building, and the two met at a party. In May 2008, the two convinced their landlord to let them divide the floors of an empty building into semi-communal offices and rent them out; this was the start of Green Desk. Green Desk was an eco-friendly coworking space, with a focus on recycled furniture and wind-power electricity. McKelvey and Neumann eventually sold the business to their landlord, Joshua Guttman, and evolved the concept into WeWork.

WeWork was founded in 2010, with its first office space in the Manhattan neighborhood of SoHo and then it never looked back.

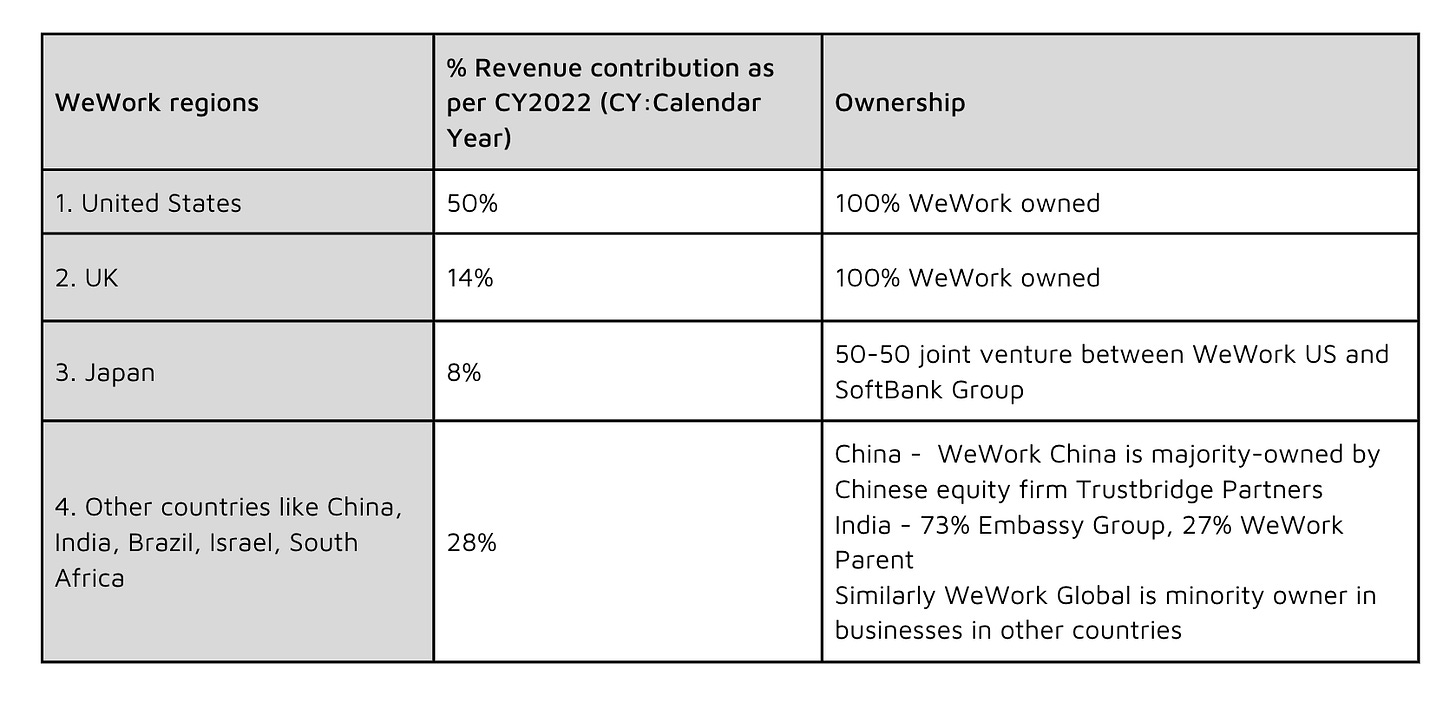

let's understand the regions that contribute revenue to WeWork and their ownership structure

*Note - Most of the property leases in the US and UK are owned by WeWork where some are shared with the lenders who've loaned money to WeWork to buy them.

Also, International markets like India, China, Israel, and South Africa are the locations that typically generate ongoing management fees for the Company at rates ranging from 2.75% to 7.00% of the above revenue mentioned. So even though international markets contribute a great revenue but the money made on that is peanuts 🥜

<aside> 💡 So when we say WeWork faced troubles, the majority of its problems are with WeWork US which also contributes 50% of business to the total revenue.

</aside>

Before we understand How WeWork India and other international competitors in this space are doing let’s start with what drove WeWork Global to bankruptcy.

1/Problems with gross margins and over-supply 📉

In CY2022 (CY: Calendar Year), WeWork had a membership and service revenue of $3.20 billion. Against that, it had location operating expenses of $2.91 billion. Even before we consider depreciation and amortization expenses for those spaces, the company’s core product had low-brow margins even after years of work to improve its operating base. All that work got it the sort of margins you expect to achieve from selling milk.

A big reason for this is money that they raised from softbank at hefty valuations demanded WeWork to keep expanding in short time which led to over supply of co-working spaces which also led to landlords taking advantage of them which led to low gross margins and they lost even more money in hard times like covid lull in 2020 and 2021 when the topline struggled.

2/Problems with the high cost of servicing the Debt 💸

When WeWork was on an expansion spree with all that capital it got from Softbank and interest rates in the US being low it started buying commercial properties at premiums. These properties were again leased to WeWork for its co-working business and thus WeWork was paying for both rental as well as servicing the debt of those assets.

There’s no issue with this strategy (Indigo Airlines does this for their planes by buying planes at cheap and rent them to themselves cheaper) if you buy the properties at an affordable cost but commercial properties do not work that way, they hardly drop their value as their market value is defined as per the rental yield they can generate.

At the start of 2023, WeWork had $4 Bn in debt (Apart from long term lease commitments) and this expensive debt became a huge problem as WeWork progressed and as interest rates went up in the US it created more losses.

3/Problems with Non-core business expenses 💔

Apart from the high cost of debt which led to losing a big chunk of money upfront, WeWork continued to pump money into Acquisitions and especially non-core business acquisitions. Since 2015 WeWork has done 21 acquisitions and many of them were related to core business such as office management startups, construction software and architecture design firms, marketing tools and messaging services and most of them were running into losses even post-acquisition.

However many of the founders whose companies were acquired did not stay on to work for WeWork, reportedly because of a "cultish" culture that did not favor outsiders which meant that WeWork spent more money hiring multiple people to run those.

A few such overpaid acquisitions were (Acquisition amount paid by WeWork) Meetup: Online and offline event booking platform (~$180Mn), Flatiron: An online coding school ($40Mn), Wavegarden: a Wave generator startup for surfing ($13Mn), Conductor: Marketing Software ($115Mn)

Also if you take note of the last known valuations of those startups which seems to be the amount paid by WeWork we can say that WeWork mostly overpaid them and could have had internal teams to start those for a fraction of that cost.

Conductor, a Marketing software startup that WeWork acquired for $115Mn was sold back to its founder for less than $5Mn

4/Is Co-Working model unviable? How are other international competitors from this space performing? 🏦

After reading the first 3 points you must be wondering the whole model of co-working is unviable and it’s the most obvious after reading the above but it’s not! Many international players are profitable and still growing.

IWG (Regus and Spaces) (founded in 1980) is WeWork's competitor and you probably must have not heard of them but does the business in the most non-fancy way. In 2022 it reported a revenue of $3.33 Bn (24% revenue growth) with a profit of $178Mn! This was their highest revenue in the history of 34 years which means the space is better than ever before.

Many other players like IWG are growing in double digits and making profits or getting there in the near term, reasons for success are

Low or no marketing spending and focusing on Word Of Mouth to grow

Building demand first than supply thus not losing money upfront and signing draconian lease contracts

Operating no frills and thus passing on the benefit to customers than creating a 5⭐ experience and charging 2⭐ in the hope of charging 10⭐ in the future.

5/Reasons why WeWork India is consistently growing and profitable 🇮🇳

Occupancy Rate: WeWork India’s occupancy rate is 87% vs WeWork US is 72% mainly because WeWork has had a prudent growth strategy and works to build demand first before building supply thus improving their occupancy rates pretty much from the get-go. Each 1% in occupancy reduces your losses as most of your costs are fixed.

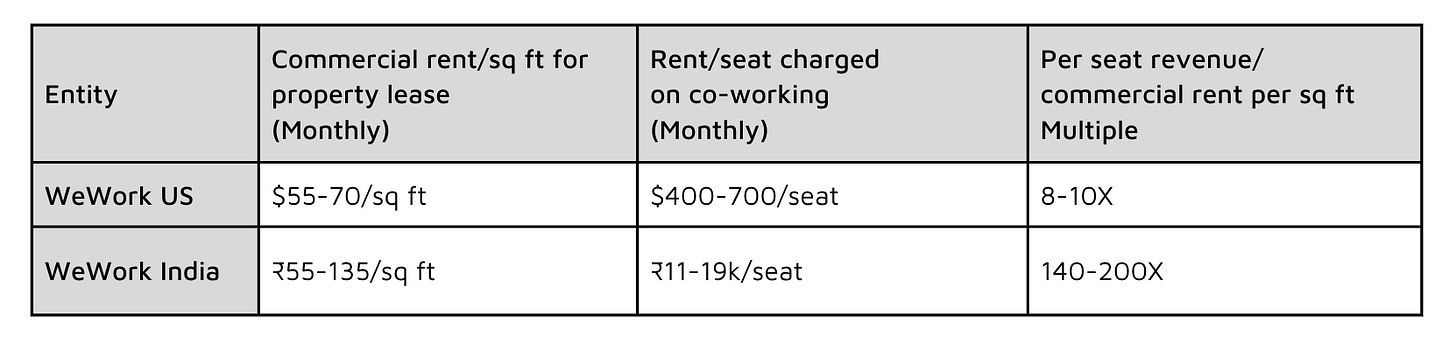

Per Sq ft and per seat business metrics: WeWork India clearly wins in the gross margins race. Even though other players in the Indian market are cheaper than WeWork India, WeWork’s premium positioning still attracts enough customers.

Cultural Nuance: I don’t know whether it’s our homes or internet infra the Indian workplaces are lot hands on which demands them to be at office. Work from office vs work from home As of March 2023, around 35% of US employees are still working from home Vs in India the same number is around 10% with many companies already implementing a hybrid model and many small startups with less than 50 employees are also working from the office all week or hybrid. This is driving more demand for office spaces in India and WeWork India is taking great advantage of the situation.

6/Future of WeWork Global and WeWork India 🛝

WeWork Global is filing for chapter 11 bankruptcy in the US is a smart move as in the United States it's seeking to renegotiate terms on leases 🔻 with landlords as part of its bankruptcy proceedings through Chapter 11 bankruptcy protection. With that, we might hope that WeWork comes out of bankruptcy and continues to operate and reach profitability someday.

WeWork India is looking to buy back 🤝 the remaining 27% stack from its parent and WeWork India might rebrand itself if WeWork Global can’t navigate out of bankruptcy and that causes more harm to the brand thus hurting WeWork India which is doing much better.

Whatever happens, I’m rooting for WeWork as I love them and strongly believe a co-working business is meant to provide a lot of value to its customers and also be profitable.

Fun Facts: (Did you know?)

Kibbutz Roots: One interesting fact about WeWork is its connection to a Kibbutz in Israel. The concept of communal living and sharing resources, which are central to WeWork's community-driven ethos, draws inspiration from the founder Adam Neumann's experiences growing up on a Kibbutz, a type of collective community in Israel.

Back in the day when WeWork was on a bandwagon of growth, WeWork hired a full-time employee whose role was to offer tequila shots to members in New York offices on Fridays.

Credits and Citations

I don’t write in a fashion where I can mention each source of the information which will make it a lot lengthy and break the flow of reading but I’d like to mention all the sources who helped me with this great piece with great gratitude 🙏🏽.

Wikipedia, YahooFinance, Techcrunch, WeWork website, Pitchbook, Techcrunch, Economic Times, Moneycontrol, Investopedia, costar, Business Outlook, inc42, Google, ChatGPT, Bard